The Bank of Manchester – Speculation, Boom and Bust in the 1830s (Part One of Two)

by Ray Berg and Alan Dyer

Introduction

In previous articles, we have seen the influence of the Fargo brothers, Stephen, James and Alonzo, in the early development of commerce and government in Manchester Village. The brothers opened the first general store on August 21, 1833, and James Fargo served in organizing Manchester Township as its first supervisor, and in establishing the Manchester Village Lyceum for educational, scientific and moral enlightenment. The year 1837 proved pivotal to Manchester, as Michigan entered the union, Manchester Township was formed, and the village itself got caught up in a speculative and frenzied era whose “bubble economy” had many similarities to financial events a few years ago. As our economy recovers from the credit crunch, real estate foreclosures, and bank failures of past years, let’s look back to 1837-1840 when the Bank of Manchester was created, grew and died in the days of “wildcat banks” and banking fraud.

Background

The opening of the Erie Canal in 1825 made pioneer travel easier and much more economical, which started a tide of emigration that rapidly swept westward for more than a decade. Detroit and Monroe served as terminals of the principal water routes from Buffalo, and the population of Michigan Territory increased from 31,639 in 1830, to 87,278 in 1834 and 175,169 in 1837. This rapid increase of population, and the equally rapid taking up of available government land, aroused fierce speculation in real estate. It was not uncommon for a "promoter" to hunt up a mill site or some other location supposedly available for a town site, purchase a quarter section from the government at $1.25 an acre, make a plat showing the river and mill site, waterfront lots, a public square, and other home sites, and then promote a golden vision of the future. The speculative value of land and general inflation quickly rose throughout the 1830s, and new sources of capital were required to keep up. Federal banking policies promoted by Andrew Jackson also led to government surpluses, distribution of reserves to state banks, and a rapidly growing sense of business euphoria by 1837.

This speculation also led to a craze for internal improvements, such as railroads, canals, dams and plank roads. Because the purported capital needs for these improvements far exceeded the available money (which was almost exclusively “specie”, or gold and silver coinage), and because a regulated banking system as we know it now did not exist, local pressure developed to create a “free banking system”. This law was intended to promote the development of local infrastructure and to aid local farmers in land development when specie was limited. This consisted of local banks established by a group of twelve or more residents, upon application to the county treasurer and clerk for the right to conduct business. On March 15, 1837, the Michigan State Legislature passed a law allowing the formation of these banks, which initially did not require a state charter and were not subject to any Federal regulations.

The Bank of Manchester

The young village of Manchester certainly considered itself a candidate for prosperity and growth, and no doubt was influenced by the frenzy in land speculation, the booming economy of the times, and the resulting inflation in prices. The bank was organized in October 1837, and was capitalized at $ 100,000, with the sale of stock to take place at the Manchester Hotel from November 6-9, 1837. During the appointed days, the residents of Manchester and the surrounding townships eagerly subscribed to the stock of what they saw as “their” bank, and the issue was quickly sold out. A list of stockholders as has survived is shown in Figure 1 below:

Figure 1 – The Stockholders of the Bank of Manchester, as printed in 1839.

This list might be considered to include the leading citizens of the Manchester area at the time.

The names of the bank’s nine directors have not been positively determined – a fire destroyed the internal records of the Michigan Bank Commission of that period. But we know that George Howe served as the bank’s first and only president. Howe had arrived in Manchester in 1832, settling in what was then called Hixon Township, and in 1833 was elected first supervisor of Bridgewater Township. Andrew G. Irwin was elected as cashier for the bank. The bank began operations on November 22, 1837, two days after the first notes were signed by Howe and Irvin. In December, it was included in a state list of banks that had begun, or were about to begin, operations, but had not been visited by state bank commissioners.

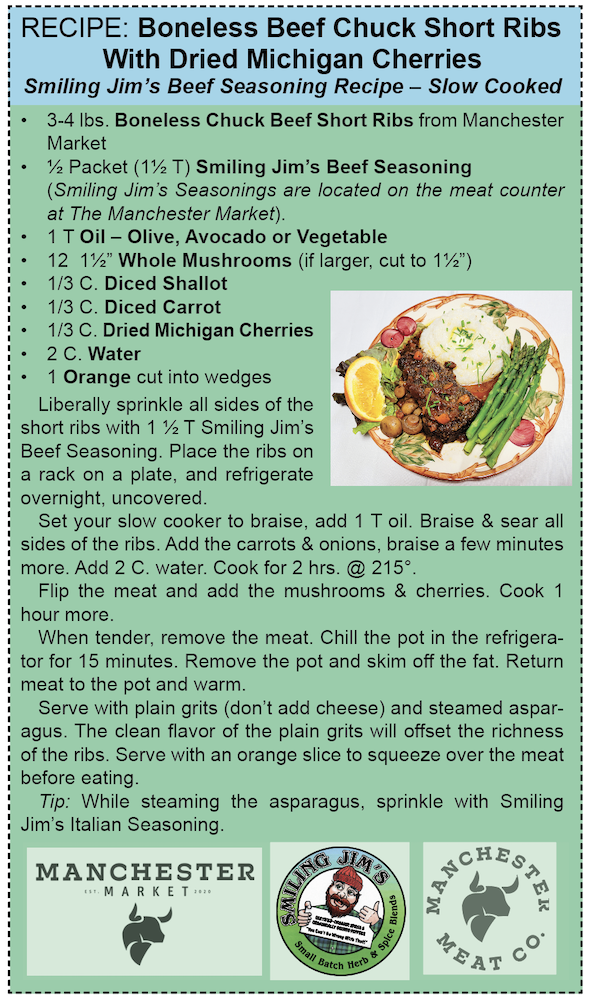

The Bank of Manchester, like all free banks established under Michigan’s law, created bank notes to transact its business and encourage capital flow. The bank took advantage of commercial printers who stood ready to issue highly ornate and idealistic engravings which would instill confidence and pride in their holders. Vignettes or illustrations highlighted rural scenes, fertile lands, large and healthy cattle, and images of Revolutionary War heroes. Prosperous farmers sowing their rich lands and beautiful farm wives wielding the sickle would often grace these bills. The bills also carried the term “Safety Fund” and “Real Estate Pledged and Private Property Holden” to promote further confidence in the bank. The Bank of Manchester started off with the full faith of local stockholders and a belief that the “good times” created at the end of Andrew Jackson’s presidency were here to stay.

Figure 2 shows the $3 bill with a likeness of Benjamin Franklin, a statesman, inventor, businessman and scientist, but also most importantly, a man of industry and thrift. A very healthy bull complements the image of prosperity. Other denominations portrayed Washington and Lafayette, and similar scenes of tranquility and happiness.

Figure 2 – The Bank of Manchester $3 Note, Signed November 20, 1837

The Michigan free banking law required 30% of the issued notes to be backed by specie (gold and silver coin) held at the bank’s location. The rest could be backed by either bonds or mortgages upon real estate within the state, or in bonds executed by resident freeholders of the state. Two problems quickly developed. Because there was initially no regulation or oversight of the specie, bankers began transferring specie from bank to bank to “guarantee” different bank notes. They also filled bank vault boxes with an upper layer of actual specie, but used it to cover scrap iron, nails, broken glass pieces and other heavy but worthless materials to create an appearance of ample specie on site. Potential problems with bonds and mortgages on real estate include inflated appraisals and depreciated real estate values, particularly when mortgages began being called in as the banks ran into trouble. In some cases, cities and villages were platted for the purpose of raising the price of land to be mortgaged for the issue of more bank bills. There is speculation that the platted village of Windham in Manchester Township, which never developed, was done for this purpose.

The Bank of Manchester is sometimes referred to as a “wildcat bank”. Various explanations have been given for this term, but the most common reference is to “reckless” or “financially unsound” Michigan banks established during the 1830s in remote and inaccessible locations, and often fictitious towns, “where the wildcats roamed.” In the free banking period, such locations benefited the banks because they hampered the note holders’ attempts to redeem notes, and banks with fewer notes redeemed could hold less specie and generate higher net revenue for their owners. The Bank of Manchester was not remote or fictitious to its local users, but it fell victim to the same speculative temptations which affected other wildcat banks. Bank of Manchester notes issued in late 1837 were themselves the focus of a major fraud committed in the wildcat Miners Bank of Dubuque, Iowa in 1838.

The Bank of Manchester was located on Lot 2 of Block 4 of the Original Plat of Manchester, which is now 107 W. Main Street. The lot was sold by James Fargo to Andrew G. Irwin on December 28, 1837 for $ 75. It is apparent that Irwin built a home there which also served as the bank office. However, after the bank problems occurred discussed below, Irwin supposedly sold the property to the Bank of Manchester on November 30, 1839 for $ 3,000. This somewhat questionable transaction was apparently negated during the bank’s troubled period, and the property was sold by Irwin to Oliver Kellogg on March 6, 1845 for $ 800. The 1856 plat map of Manchester shows no structure on this site. It is not certain what happened, and perhaps the structure was demolished or moved prior to 1856, or destroyed in the 1853 fire. But the 1864 plat map does show a structure, which is believed to be a house which was subsequently moved to 325 S. Macomb Street after a sale by Dr. Walter Klopfenstein, who built the current home at 107 W. Main in 1907. Information provided by Annetta English in an earlier Manchester history may have incorrectly attributed the original Bank of Manchester building as being the current 325 S. Macomb home.

You must be logged in to post a comment Login